Best US Loans for Chinese Homebuyers

Invest in your future - invest in US real estate

Challenges for Chinese homebuyers in the US

Challenges

- No loan offers from Chinese banks

- Foreign purchases limited by Chinese government

- All-cash payments reserved for the rich

Answers

- Finance your investment with a US mortgage

- New US opportunities for the Chinese middle class

- US residence increases approval chances and conditions

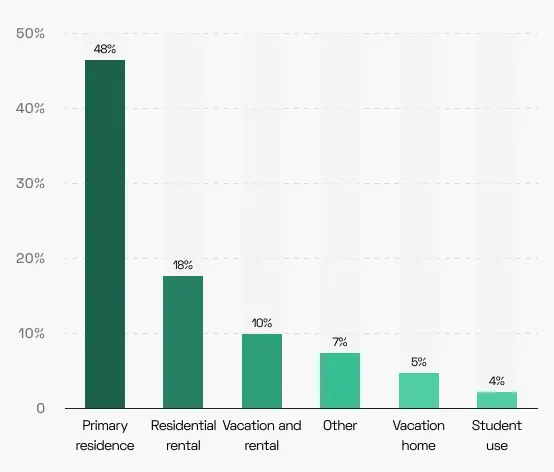

Reasons for buying a property in the US

- Primary residence - 48%

- Residential rental - 18%

- Vacation and rental - 10%

- Other - 7%

- Vacation home - 5%

- Student use - 4%

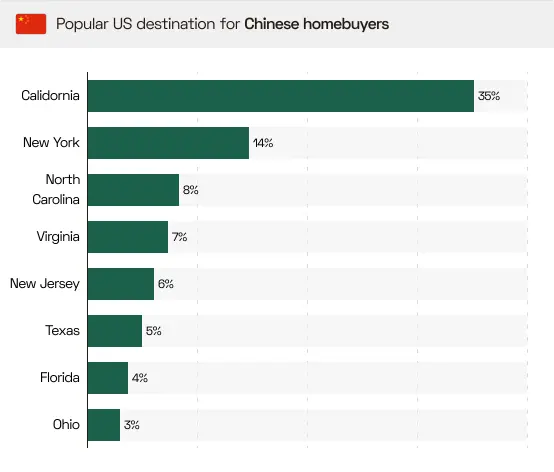

Trends for Chinese buying homes in the US

- Nearly 18.5k Chinese citizens bought property in the US that year

- Chinese citizens spent $11.5 billion in US home purchases

- The median purchase price for a property was around $450K

- 50% of Chinese homebuyers financed a home with a US mortgage

Considerations for new homeowners in the US

One time costs

US property taxes have only one time costs

Recurring costs

Property utilities, security, maintenance and community costs

Optional costs

30% withholding tax on rental profits for non-residents

Conditions for mortgage approval

Residency

Mortgage offers differ based on the status of your residency

Employment

Type of employment contract significantly affects mortgage requirements

Credit history

Clean credit history in the US or China

Down payment

Minimum 30% of property value for down payment

Income

Up to 30-50% of income reserved for monthly loan instalments

Mortgage collateral

Significantly better conditions with a US based property as collateral

Documentation you might need for approval

| Non-residents living outside the US | |

Chinese documents

Chinese documents

|

|

| Tax documents | Income Tax and Benefit Return and Notice of Assessment |

| Investment income | Last two years of investment slips |

| Salaried Employees | Last two years of income slips. Paystubs for the past 30 days of income |

| Self-employed individuals | Last two years of business returns for any entity where ownership is 25% or more, with all pages and schedules |

| Retired individuals | Most recent retirement awards letters |

| Proof of citizenship | Copy of passport, Green Card or a US visa |

| Proof of identity | Tax Identification Number |

| Proof of assets | Account statements for most recent two months per each account you hold* |

| Insurance documents | Current property owners need to provide copies of property tax notice and home insurance premiums for each residential property owned |

| Permanent or temporary residents living and working in the US | |

US documents

US documents

|

|

| Tax documents | 1040 U.S. Individual Income Tax Return |

| Investment income | 1040 Schedule B Interest and Ordinary Dividends, and/or Schedule D Capital Gains and Losses |

| Salaried Employees | W2 Wage and Tax Statement of Income |

| Self-employed individuals | 1040 Schedule C Net Profit or Loss from Business, and/or 1065 K-1 Partner’s Share of Income, Deductions, Credits, etc. |

| Retired individuals | Social Security or Awards Pension letter |

| Proof of citizenship | Copy of passport, Green Card or a US visa |

| Proof of identity | Social Security Number |

| Proof of assets | Account statements for most recent two months per each account you hold* |

| Insurance documents | Current property owners need to provide copies of property tax notice and home insurance premiums for each residential property owned |

Mortgage process duration

| Typical process phase | Estimated duration |

|---|---|

| Registration and loan inquiry at Kredium | 5-10 minutes |

| Mortgage pre-approval through Kredium | up to 24 hours |

| Personalized offers from Kredium | up to 24 hours |

| Mortgage application with a lender | 1-5 days* |

| Mortgage processing by a lender | 30-45 days** |

| Mortgage closing with a lender | 1 day |

Contact us

Single Business Tower, 26th Floor

153 Sheikh Zayed Rd Business Bay (Dubai)

2020 Silver Creek Rd, Bullhead City,

AZ 86442 (USA)